Consumer Driven Care Learning Center

The Consumer Driven Care Learning Center and newsletter, brought to you by MCOL, have been developed to provide a resource for health care professionals interested in Consumer Driven Care and related programs.

Consumer Driven Health Plans

Consumer Driven Health Plans combine a tax advantaged and funded spending or savings account with a high deductible insurance policy. Typically these account-based plans involve either a Health Savings Account (HSA) or a Health Reimbursement Account (HRA). The companion insurance policies for HSAs must meet the regulatory definition of a High Deductible Health Plan (HDHP).

Other Aspects of Consumerism

Consumer Driven Care, in addition to the narrower context of Consumer Driven Health Plans, is referred to by some stakeholders somewhat inter-changeably with the broader aspects of health care consumerism. Health care consumerism encompasses a wide range of components involving the engagement and empowerment of consumers in the delivery of health care services and benefits.

Other types of health benefit design, in addition to consumer driven health plans, that might fall under the umbrella of consumerism could include:

- Defined Contribution Health Plans

- Customized Health Plans

- Value Based Benefit Design

- General deployment of increased consumer cost sharing requirements

Other trends, strategies and business models that can be considered aspects of consumerism could include:

- Wellness participation incentives

- mHealth applications, web based tools and portals

- Health Care Social Media

- Retail Clinics

- Medical Tourism

- Direct to Consumer Advertising

- Health Insurance Exchanges

Tax Advantaged Health Savings and Spending Accounts:

Flexible Spending Accounts (FSAs): pre tax accounts where unspent balances may not be rolled over, other than for a 2.5 month grace period after each plan year. Often offered as separate component of cafeteria plans. Created in 1978. FSA tax provisions were modified under the Affordable Care Act whereby employees may not choose an annual election in excess of a limit determined by the IRS, which was set at $2,500 for the first plan year beginning after December 31, 2012.

Health Reimbursement Arrangements (HRAs): employer funded pre-tax accounts where unspent balances may roll over from year to year. No employee portability. Typically offered in combination with high deductible plans. Created in 2002.

Health Savings Accounts (HSAs): pre tax savings accounts funded by employers or employees/individuals that must be offered in combination with qualified High Deductible Health Plans. Provides for employee portability and investment of account funds. . Effective in 2004.

Medical Savings Accounts (MSAs): pre tax savings accounts with many various qualifying provisions. Created in 1996. No new accounts may be opened as an MSA since 2007.

The following table summarizes comparative provisions of the major types of accounts:

|

FSA |

HSA |

HRA |

|

|

|

Consumer Driven Health Plan Design and Structure

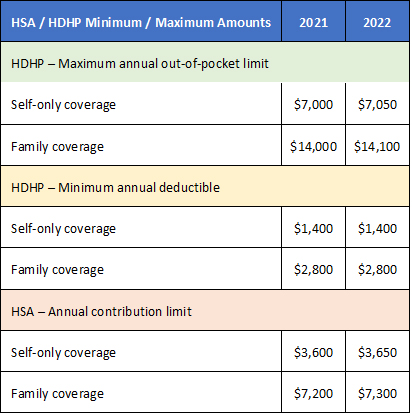

For Health Savings Accounts, the Insurance Plan must be an IRS defined High Deductible Health Plan, with a minimum Annual Deductible and maximum Annual Account Contribution amounts set annually by the IRS. HSAs may be arranged by individuals or by Employer or other qualified groups.

Health Reimbursement Accounts may only be arranged by Employers or other qualified groups, and may be offered without a companions health plan. Most HRAs are offered with a companion plan, that can be an IRS defined High Deductible Health Plan, but can also fall outside the IRS High Deductible Health Plan specifications.

The Difference between the Funded HRA or HSA, and the Deductible amount is the Gap that Employee must pay out of pocket, unless the employee also has a funded Flexible Spending Account (FSA) to pay for the difference.

The Insurance Plan's Preventive Care Benefit it typically not subject to the Deductible amount (the preventive benefit has first dollar coverage)

Annual HSA and HDHP Minimums and Maximums

Source: IRS Revenue Procedure 2021-25